The Joule-er’s Accountant and Energy Return on Investment

Energy Return on Investment (EROI) is a fundamental concept in the field of energy and power generation

Tuco’s Child Preface

One of the great things about Substack is the ability to correspond and collaborate with experts in their respective fields. It is a great way to learn from others and disseminate information. To that end, I present a guest post by K.T. Lynn, a person with experience and expertise in the field of energy and power generation, and whom publishes The Joule Thief, a very informative energy newsletter. The following article arose from conversations with K.T. about Energy Return on Investment as a fundamental concept that is essential to understanding the relative energy densities of different fuel resources.

King of EROI: Phoenix is powered by the Palo Verde nuclear generating station, about 50 miles west on 4,000 acres with three reactors cooled by waste water, producing 3.8 GWe.

The Joule-er’s Accountant and Energy Return on Investment (EROI) by K.T. Lynn

On January 10, 1901, an oil drilling expedition led by Pattillo Higgens and Anthony Lucas at Spindletop, Beaumont, Texas hit the jackpot. When the workers reached a depth of 1,139 ft (347 m), oil came spurting out of the ground in an enormous geyser (called the Lucas Gusher), sending cascades of crude 150 ft (50 m) into the air. The Lucas Gusher spewed 100,000 barrels per day for nine straight days before it was finally brought under control. The Age of Oil had begun.

In those early days, striking it rich with black gold was like shooting fish in a barrel. The East Texas Oilfield, discovered in 1930, was the largest oil deposit ever found in the continental U.S., producing some 5.42 billion gallons to date. Soon, major oil reserves were discovered in the neighboring states of Oklahoma, Louisiana and Arkansas, as well as California. The U.S. had quickly become the world’s top petroleum exporter.

Jed Clampett strikes it rich! The Beverly Hillbillies

The common thread underpinning the boom days of U.S. conventional crude was the ease of extraction, and corresponding high return on investment that propelled economic and industrial growth throughout the world. Although the U.S. oil industry began to wane by the 1960s, discoveries such as the Ghawar oil field in Saudi Arabia and Burgan field in Kuwait have continued to quench the world’s insatiable thirst for oil.

However, as all good things must come to an end, the days of easy conventional crude are largely over. Since the 1970s, only a handful of new fields with >1 billion barrels of recoverable oil have been found. This has led to a renaissance in petroleum engineering innovation, as oil companies have developed strategies such as horizontal drilling and hydraulic fracturing (fracking) to access deeper wells and oil embedded in shale source rock. While the U.S. is currently enjoying a resurgence as the world’s largest oil producer, thanks to fracking in the Bakken and Permian Basin, oil and gas engineers are increasingly in need of tools to model and comprehend the economic and environmental cost-benefit analysis of such operations. As resources begin to dwindle, eventually the energy required to extract petroleum from exhausted fracking wells exceed the energy (and monetary value) of the oil that is produced.

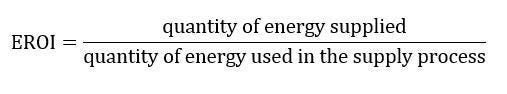

Enter the concept of Energy Return on Investment (EROI), first developed by environmental economist Charles Hall in the 1970s. Simply defined, EROI is “the ratio of energy returned to energy invested in that energy source, along its entire life-cycle.” EROI can be expressed as the following mathematical formula:

The “quantity of energy supplied” is defined as the energy produced and available to perform useful work, while the “quantity of energy used in the supply process” includes the energy needed to extract the resource, as well as embodied energy along the logistical supply chain (e.g, running equipment, and fueling transportation and delivery). The purpose of the EROI measurement is to develop a consistent framework to calculate and compare the relative energy density of different forms of resources, and different grades of the same resource (e.g., conventional oil vs. fracked shale oil or tar sands). An instructive example, as highlighted by environmental scientist James Conca in an article for Forbes, describes the overall decline in the EROI of the world’s oil resources over time:

“In 1930, 1 joule of energy put into oil got 100 joules of energy out, an EROI of 100… in 2006, 1 joule of energy put into oil got only 15 joules of energy out.”

According to experts in the field, the EROI of a resource must be at minimum 5 to 7 in order to provide a net positive energy yield. Anything below this threshold is uneconomic and incapable of supplying the energy needs of society. The graph below, by geologist and EROI specialist Euan Mearns, visualizes the energy required to produce usable energy, demonstrating the exponential increase of energy invested (and corresponding drop-off of usable extracted energy) at EROI<5. This is called the “Net Energy Cliff.”

The Net Energy Cliff

Although EROI as a fundamental concept is essential to understanding relative fuel density of different resources, the methodologies and assumptions used as inputs and outputs in the EROI equation can differ wildly between researchers. One common mistake made by some analysts is to conflate the energy invested with the monetary value of the energy invested. This leads to distortions such as erroneously including fixed charges such as administrative overhead and wages to the energy-invested quotient. This in turn can lead to artificially low EROI scores, especially for power plants that require robust O&M procedures, such as nuclear facilities.

Another frequent problem found in EROI calculations is a lack of consistency in the weighting of different values for different types of energy resources. This is particularly prevalent when analysts assign a higher weight to renewables such as solar and wind because they use electricity as the primary energy source, compared to coal, natural gas and nuclear, which all rely on various modes of fuel conversion. The rationale is that thermal losses during conversion make the resulting energy productivity inherently less efficient than sources that natively use electricity. However, as the energy density between solar photovoltaics (PV) and nuclear fission vary by orders of magnitude, these arbitrary weightings do not reflect the true value of each respective power source.

To correct these problems, Weißbach et al published a paper in 2013 seeking to more thoroughly ground EROI in its relationship to exergy. Weißbach defines this as the “physical process which transforms primary energy to exergy defined as the usable work inside a system with borders to (most frequently) the surrounding.” Using the exergy process approach allows the authors to dispense with weighted values for renewable primary energy, as primary energy is not considered as an input. At the same time, the focus on the purely thermodynamical aspects of the system prevents confusion between energy and money invested. Thus, this methodology creates the conditions to compare all fuel sources on a purely mathematical and physical basis in an “apples-to-apples” manner.

Weißbach’s findings reassert what most people with a sense of physical reality understand intuitively: nuclear energy is the EROI champion par excellence, at a return rate of 75:1. Hydroelectric, coal, and combined-cycle gas turbines (CCGT) are also high performers. Concentrated solar power (CSP) and wind energy only pencil out at the economically-viable threshold if they are considered without combined storage (also called “buffering” in EROI parlance). This is because current battery storage technologies dissipate more thermal energy than they can store from intermittent resources. However, Weißbach’s scenarios demonstrate that even pumped hydro storage (which is much more efficient than batteries) only marginally surpasses the threshold for CSP (EROI=9), and remains unviable for wind (EROI=4). Finally, rooftop solar PV and biofuels are always uneconomic, and should not play major roles in incentive and subsidy programs. The graph below shows the full range of Weißbach’s EROI results, with and without buffering.

EROI, with or without buffering| Weißbach et al 2013

Conclusions

EROI is an important concept and key to truly understanding the physical and economic viability of various energy sources. Stay tuned for Part II of this series, where we will be collaborating with nuclear energy expert Gene Nelson, Ph.D. of GreenNuke, to more thoroughly explore the awesome power of nuclear as an EROI superstar and crucial element for a “sustainable low-carbon future”.

Glorious flick

I follow the energy generation circus. It is a mass of confusion, where a kid who sailed a sailboat somehow has cred as an energy engineer. Our politicians mouth off, clearly ignorant on any of the requisite science and engineering.

This post is unique relative to anything else I've read. It considers the costs in terms of energy in/energy out. It's an eyeopener. I've been saying for years that, if solar and wind are so economical, why do they have to be so massively subsidized? It doesn't take an engineering degree to see that we are being bamboozled yet again.

Fantastic, thank you.