BlackRock "Sustainable ESG Funds" Secretly Invested in Fossil Fuel Development

Greenwash by the usual suspects - follow the money!

Tuco’s Child Preface

Scandal ! Are we surprised that cash is king and that ESG virtue signaling is easily tossed aside when returns on investments are threatened?

Our “sustainable” whistleblower friends at Reclaim Finance have uncovered the following :

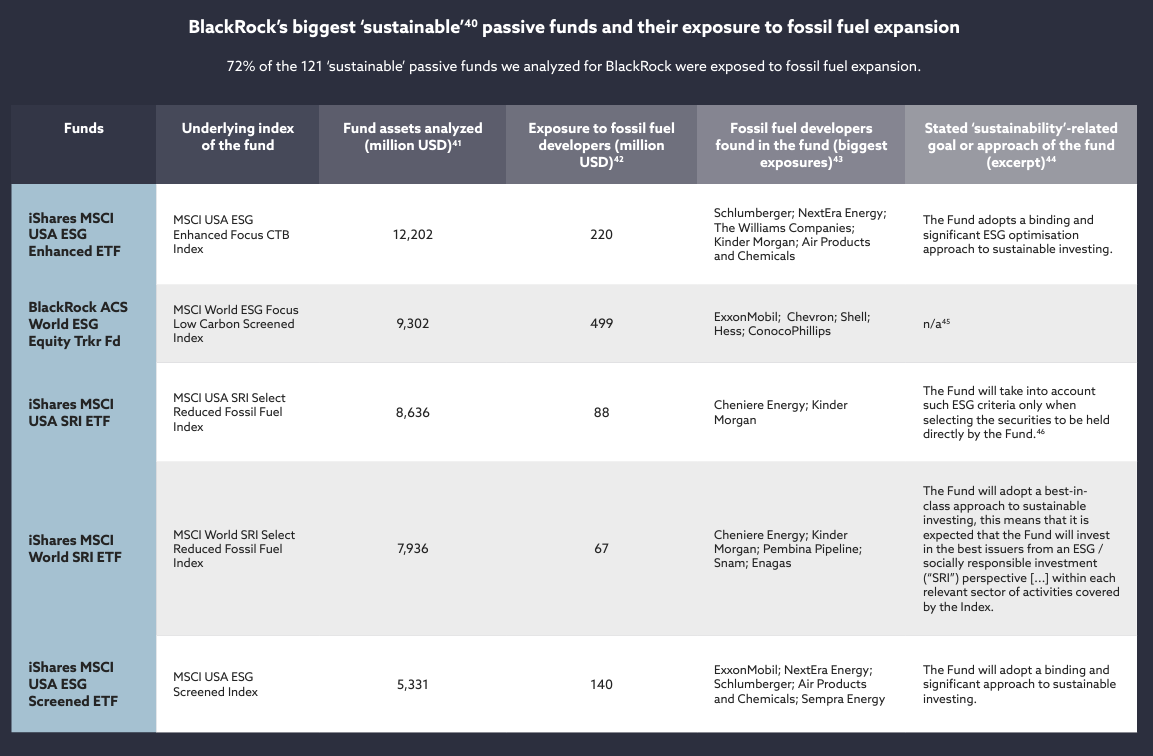

Asset managers are greenwashing passive ESG funds, according to a new analysis. With the number of passively-managed investments growing, Reclaim Finance examined 430 “sustainable” passive funds managed by five of the biggest asset managers in Europe and the United States and found that 70% were exposed to companies developing new fossil fuel projects.

Reclaim Finance is warning that these investments are fueling climate change and is urging regulators to outlaw sustainable claims for funds supporting fossil fuel expansion.

Out of these 430 funds, 304 (70%) were exposed to fossil fuel expansion – we found a total of 416 fossil fuel developers in at least one of these funds. One of the ‘sustainable’ funds analyzed even had a record 87% exposure (in terms of market value) to fossil fuel developers….

Profits!

BlackRock “ESG & Sustainable Funds” are invested in fossil fuel companies per Reclaim Finance

Details here in pdf of report:

Suckers! Brought to you by the BlackRock Billionaire Larry Fink, Architect of Woke Capitalism

“Society is increasingly looking to companies, both public and private, to address pressing social and economic issues.

These issues range from protecting the environment to retirement to gender and racial inequality, among others.” – Larry Fink, BlackRock CEO 2019 “Letter to CEOs” and “Climate risk is investment risk”

Paybacks a Bitch

Texas Pulls $8.5 Billion From BlackRock Over ESG Wokeness

Texas will pull some $8.5 billion in investments from BlackRock over its ESG policies, the biggest such divestment after several Republican states have moved to cut ties with firms that conservatives see as privileging liberal goals.

Texas State Board of Education Chairman Aaron Kinsey announced the move on Tuesday. A letter was sent to BlackRock the same day notifying the world’s largest money manager. [emphasis, links added]

The divestment was done to comply with the state’s anti-environmental, social, and governance law, which prohibits state investment in companies like BlackRock that Republicans say boycott energy companies.

“BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil and gas economy and the very companies that generate revenues for our [Permanent School Fund],” Kinsey said. “Texas and the PSF have worked hard to grow this fund to build Texas’s schools.”

“BlackRock’s destructive approach towards the energy companies that this state and our world depend on is incompatible with our fiduciary duty to Texans,” he added.

BlackRock, though, argues that it is helping millions of Texans and emphasizes its investment in the state.

“On behalf of our clients, we’ve invested more than $300 billion in Texas-based companies, infrastructure, and municipalities, including $125 billion invested in the energy sector, including $550 million [in] a joint venture with Occidental,” a spokesperson said in a statement provided to the Washington Examiner.

“We recently hosted an energy summit in Houston designed to explore how to strengthen Texas’ power grid.”

ESG is a financial concept that centers on compelling social change through investment and divestment.

It is a corporate model that doesn’t solely look at maximizing profit but also incorporates other elements into financial decisions — for instance, how an investment might affect fossil fuel emissions.

SOx was supposed to stop investor-owned utilities from playing capital/O&M bookkeeping games to manipulate their O&M ratios, book and stock values.

SEC then handed it over to FERC to enforce.

The fox guarding the fox coop.

Was in power gen 35 years & saw it firsthand.

Evade, Scam, and Gamble (with your retirement fund). What a crock. Good on Texas.